The 15-Second Trick For Personal Loans Canada

The 15-Second Trick For Personal Loans Canada

Blog Article

The Best Strategy To Use For Personal Loans Canada

Table of ContentsSome Of Personal Loans CanadaAll about Personal Loans CanadaNot known Incorrect Statements About Personal Loans Canada The Greatest Guide To Personal Loans CanadaGet This Report about Personal Loans Canada

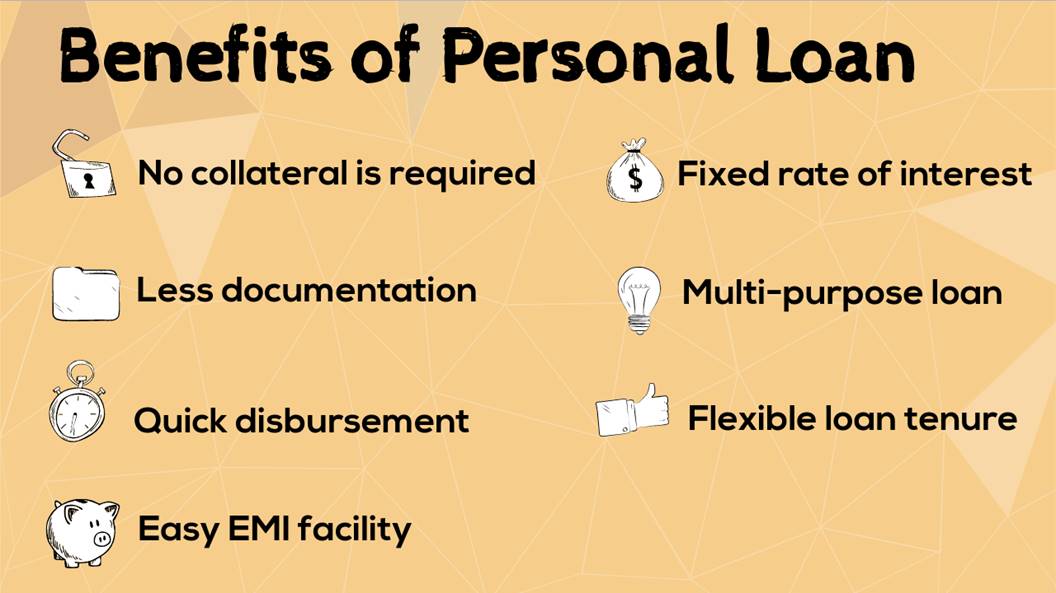

Payment terms at most individual finance lending institutions range between one and 7 years. You receive all of the funds simultaneously and can utilize them for almost any kind of function. Customers commonly utilize them to finance a possession, such as a vehicle or a boat, pay off financial obligation or help cover the cost of a major expense, like a wedding event or a home improvement.

A set price gives you the safety and security of a foreseeable regular monthly repayment, making it a popular option for combining variable price credit score cards. Repayment timelines vary for individual lendings, but customers are typically able to pick payment terms in between one and 7 years.

An Unbiased View of Personal Loans Canada

The fee is usually subtracted from your funds when you settle your application, lowering the quantity of cash money you pocket. Personal lendings prices are more directly connected to brief term prices like the prime rate.

You may be used a reduced APR for a much shorter term, due to the fact that lenders understand your equilibrium will certainly be paid off much faster. They may bill a higher rate for longer terms understanding the longer you have a funding, the much more likely something can alter in your financial resources that could make the repayment unaffordable.

A personal funding is also an excellent choice to using credit scores cards, considering that you obtain cash at a fixed rate with a guaranteed benefit day based upon the term you pick. Remember: When the honeymoon mores than, the regular monthly repayments will certainly be a reminder of the cash you spent.

7 Simple Techniques For Personal Loans Canada

Prior to handling financial obligation, utilize a personal car loan repayment calculator to aid budget plan. Gathering quotes from multiple lenders can help you detect the ideal bargain and possibly save you interest. Contrast rate of interest, fees and lending institution online reputation before requesting the finance. Your credit report is a huge factor in establishing your eligibility for the loan in addition to the rates of interest.

Prior to using, know what your score is to make sure that you understand what to expect in regards to prices. Be on the hunt for surprise fees and penalties by checking out the lending institution's conditions page so you don't finish up with less cash than you need for your economic goals.

They're easier to certify for than home equity loans or various other safe finances, you still need to show the lender you have the means to pay the finance back. Personal lendings are much better than debt cards if you want an established monthly settlement and need all of your funds at once.

The smart Trick of Personal Loans Canada That Nobody is Talking About

Credit history cards might additionally provide rewards or cash-back choices that individual financings do not.

Some lenders may additionally bill fees for personal lendings. Individual financings are financings that can cover a number of individual costs.

As you spend, your available credit scores is decreased. You can after that raise readily available debt by making a settlement toward your credit limit. With an individual lending, there's typically a set end day whereby the lending will be repaid. A credit line, on the various other hand, might remain open and available to you indefinitely as long as your account stays More hints in excellent standing with your lender - Personal Loans Canada.

The money gotten on the finance is not taxed. If the lender forgives the car loan, it is thought about a canceled financial debt, and that quantity can be strained. A safeguarded personal lending requires some kind of security as a condition of borrowing.

Everything about Personal Loans Canada

An unprotected personal finance requires no collateral to obtain money. Financial institutions, credit unions, and online lending institutions can provide both secured and unsafe personal lendings to certified debtors. Banks normally think about the last to be riskier than the former due to the fact that there's no collateral to collect. That can indicate paying a greater passion rate for an individual car loan.

Again, this can be a bank, cooperative credit union, or online individual financing lending institution. Generally, you would certainly first complete an application. The lending institution evaluates it and determines whether to authorize or refute it. If approved, you'll be browse around here given the funding terms, which you can approve or decline. If you consent to them, the next step navigate to this site is completing your financing paperwork.

Report this page